Functional / Emotional Fit

What is your product or service for?

In response to this, most of us will immediately think about what sort of functional problem we are solving for our customers.

Perhaps you’re Retail Bank C offering a bank account service to help me manage my money from day to day. Great, I need that. But is it good enough? Maybe.

Until recently, is was really difficult and expensive for a competitor to start up a retail bank. Not any more. Competing retail banks are now everywhere: Atom, Curve, Monzo, N26, Revolut, Starling, blah…

Sounds good. Doesn’t it?

The problem is… making stuff people need has never been easier. Almost anyone can now join in and compete with you.

The race to the bottom

If all you have to offer is a widget that anyone else can build then you’re probably in the commodity business.

The problem with commodities is that they’re seen by the customer as interchangeable. One mobile-only, digital bank account with XYZ features looks just like every every other mobile-only, digital bank account with XYZ features. Maybe not to you, but to prospective customers.

Because they all seem the same, your customers are left with only one way to distinguish your product from the rest: price.

And so, you find yourself in a race to the bottom.

Hence the cosy cartel of UK legacy retail banks. They offer an interchangeable, barely functional solution and thereby compete largely on price. They’ve only survived this long because historically it’s been a prohibitively difficult and expensive market to enter.

Living on borrowed time

Moore’s law, globalised talent and the open source movement have exponentially changed everything. Throw in a more consumer-friendly regulatory environment and hey presto, we’re now spoiled for choice when it comes to mobile-only, digital bank accounts.

These forces have fuelled innovation and unleashed a virtuous race to the top in terms of slick user interfaces and customer experience. The consumer finance world is playing hard to catch-up with our high and fast-rising expectations thanks to the likes of Uber, Netflix and Amazon.

Some of us are putting in the extra work to figure out how to make the product as easy to use for the customer as possible. Bravo.

Is that enough? Perhaps.

Trouble is, your competition are also making their products easier to use.

To compound the problem, your customers know more about your competition that you do.

Even a widget with a great customer experience is just a shinier widget. It’s still a commodity.

It’s not that the race is isn’t winnable. It is. You too could be the next Amazon of your industry. Good luck with that.

The winner-take-all world that awaits is based on a scarcity mindset.

The box

How do we re-position ourselves away from being in the commodity business chasing ever lower prices?

Talking to and better, listening, to your customers is a start. Talking about benefits as well as features is also a good move.

Segmenting your market by demographics can help but usually not very much. ‘Digitally-native Gen Z’ narrows down your target market to a mere 2.5 billion faceless souls. How useful is that?

Constantly and incrementally improving your customer experience is necessary. But, it’s not enough.

Those things will buy you some time but you’re still peddling a commodity. Polishing a turd.

You’re trapped in a box of your own making, marked ‘commodity’.

Most companies never break out. They run in ever smaller circles around benefits, demographics and customer experience, in a stressful game of chicken with rivals over ever lower prices.

This is where the vast majority of tech startups are now. Including the big name digital banks and other fintechs. Just go and read the tag lines on their websites. Strip away the logos and try telling them apart…

Finding emotional fit

There is a way out….

The key is to realise that customers either choose by price or by value. You need to decide how you want to be chosen. It’s binary.

Becoming the next Amazon is a noble challenge. For the rest of us, the alternative is to do the hard work of identifying what your product is really for.

Why should someone want what you have to offer?

Our brains have evolved to make decisions on an emotional basis. And then rationalise after the decision has been made.

They don’t want your product. They want the positive emotions your product evokes.

The trick is to work out the emotional change your potential customers want, and how you can help them get there.

You also need to consider who your target market is. Hint: consider segmenting along psychographic rather than demographic lines.

Who is your product or service for? And why should they care?

Tap into that, act on it and you stand a chance of finding emotional fit.

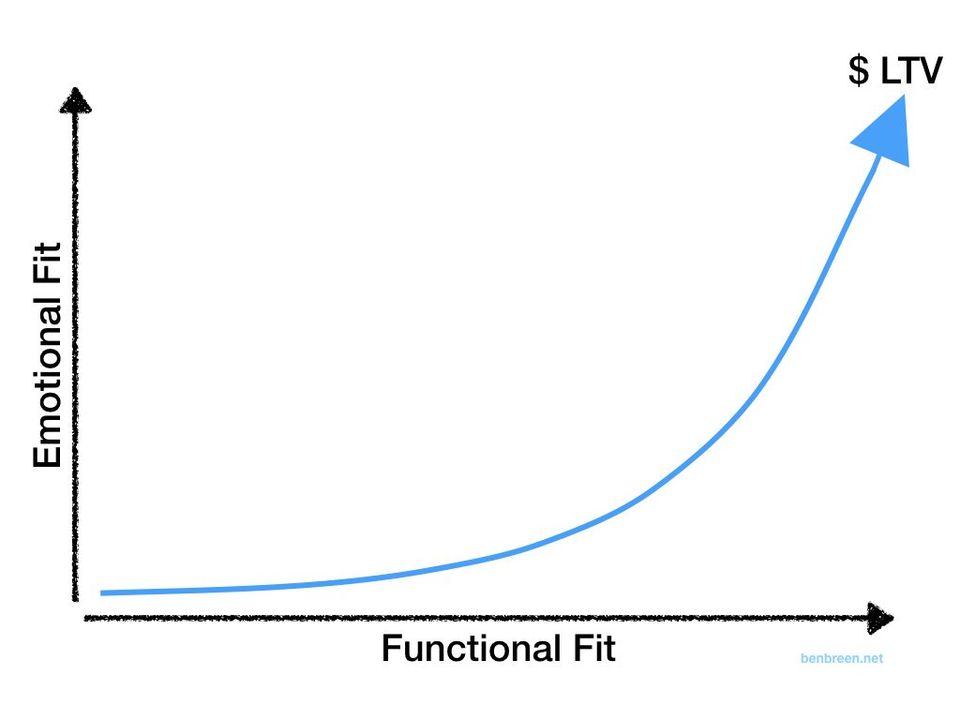

Unlocking higher customer Lifetime Value

Once you have functional and emotional fit then it’s much easier to position your product as part of a story. A unique story.

This means you no longer have to compete. Emotionally bought-in people will pay higher prices. Look at Apple.

A distinct emotional connection makes it easier for the right people to choose what you have to offer. Compare the effectiveness of the emotion-led Brexit Leave campaign to the impassive Remain campaign.

And (assuming your customer experience delivers), customers will stick with you for longer. Higher retention rates.

They’re also more likely to tell their friends. More referrals. As the CEO of Harley Davidson said, “We measure the percent of our customers who have our brand tattooed on some body part.” How about that for a metric?

Net, net, your customer lifetime value (LTV) will go up.

Finding emotional as well as functional fit is hard, but you might want think twice about the alternative.