Cloud Accounting 'Peace of Mind': FreeAgent Review

I’ve been grappling with ‘doing the books & records’ for my own small businesses since 2001, and it’s always been stressful and tedious.

I’m sure I’ve lost hair & reduced my life expectancy by several years trying to reconcile spreadsheets of numbers: for invoices, expenses, bills, paid, due, overdue, straddling accounting periods. And that was just for a single VAT return.

Each year from 2002 to 2011, I would lock myself in my home-office for endless days and nights trying to prepare ‘records’ for my accountant to do the annual accounts.

That was then…

A few weeks ago I got an email from the accountant asking for the numbers again. But this time it was different. It took me 5 minutes to sense check all was in order. I then I pinged him back, asking him to sign-in with his own account and he had full access to all the numbers he could possibly want.

A few days later he emailed me the draft accounts – with the message that his assistant ‘really liked’ the accounting software I was using. (I’m not surprised since it pretty much did her job for her!)

That accounting software is called FreeAgent and it’s what I’ve been using for the past 18 months.

FreeAgent describes itself as painless online accounting. It is part of a new wave of accounting solutions for small businesses & freelancers based on Cloud computing. This means that there is nothing to install or upgrade, nothing to backup, and you can use it from anywhere you have an internet connection.

This is my summary of how FreeAgent has changed my life, what I like about it, and what could be improved.

‘Peace of Mind’

For me, a key test for any business software or service is how much ‘peace of mind’ it can bring me.

In the case of small business accounting this means asking: how much will this service allow me to stop worrying about missing tax deadlines, getting paid on time, keeping my customers happy, avoiding penalties, and generally keeping my cashflow in order.

On this basis FreeAgent has brought me almost total ‘peace of mind’.

Reminders

Of course no software can stop a client paying late but now I get to see really clearly who owes me what and when so I can chase up at the right time. It’s put me right back in control.

I also get reminded of upcoming bill and tax deadlines for VAT, PAYE/NI and Corporation tax.

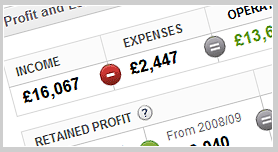

Dashboard

When you sign-in you see a clear and reassuring Dashboard summary of your headline numbers:

- Invoice payment timeline showing which are paid, due and overdue

- Open and overdue bills & invoices

- Bank & card balances graphed over time

- Recent expenses & billed time

- Profit & Loss for the current year

- Current retained profit and how much can be paid out as a dividend right now

You can even reorder this info by clicking and dragging. Super simple.

Improved Client Relations

For each of your clients or customers, it’s super easy to set up their contact details including email and VAT numbers. You can then assign them to projects and tasks. You can also import contacts from Basecamp and sync them with Capsule CRM.

It’s easy to generate and fire off estimates, time sheets, and invoices for any of your contacts – all from within the service. It’s also straightforward to brand these comms with your own logo.

Time Saving

The second test I use for judging any business tool or service is how much time it’s going to save me. In business, time after all is money. How much is your time worth?

I now spend around 30 minutes per month uploading bank statements and explaining anything that FreeAgent has not seen before. I also make sure the balances reconcile with the figures at the bank itself – they always do so this is a 1 minute job.

Once a quarter, I generate & file a VAT return. This takes 1 or 2 minutes.

Once a year, I’ll spend 30 minutes or so sense checking. I had no issues this year as it had been so easy to keep everything up-to-date throughout the year.

In between, it’s 2 minutes to setup a new bill, fire off a new invoice, or setup a new client or customer contact.

…and that’s about it.

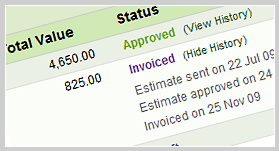

Estimates & Invoices

Generating and emailing estimates, time sheets and invoices to clients takes just a few clicks. This must have saved me many hours.

Generating and emailing estimates, time sheets and invoices to clients takes just a few clicks. This must have saved me many hours.

Bills & Expenses

Tracking a recurring bill payment is a simple matter of setting up its details and payment frequency, once. I set these to sync up with standing orders through the bank. It’s useful to see all bill payments together over time, and as well as the recent ones in the Dashboard.

Expenses are handled in a similar way to bills.

Set, and (don’t) forget.

Banking

FreeAgent shows your bank balance graphed over your preferred timeline. It can do this for multiple bank, PayPal and card accounts.

It’s also easy to switch between transaction views by month and accounting year.

You either add each transaction manually, or in bulk by uploading an electronic statement from your bank.

Adding a transaction for a Bill or Expense is easy as the details are already there.

FreeAgent offers intelligent defaults and options when adding transactions. For example, when adding a Bill, the options are reconfigured to select from the list of Bills it already knows about. If adding a Purchase of Capital Asset then you get to select a depreciation period.

In all cases you can upload a scanned receipt, invoice or other document.

Taxes

If you’re VAT registered then the service works with both the regular and flat rate scheme.

Once a quarter, FreeAgent reminds me to pay VAT. A single click then instantly generates all the figures for the VAT period and shows them to me as a virtual form on screen. You get the chance to check it over and make any final adjustments.

One more click then gets the return filed with HMRC and triggers payment from your bank account. For me, this is the single best feature as it saves me literally hours of time each quarter.

FreeAgent calculates how much Corporation Tax is due as it goes along. You can go and check it out at any time for the current year and past years.

Accounting

Another great time saver is that it calculates all the accounting numbers as you go along. Add a new invoice or bill and all the accounting figures get automatically updated. At any time you can then call up any of the following:

- Profit & Loss statement

- Balance Sheet

- Trial Balance

- Aged Creditors & Debtors

- Capital Assets

- Journal Entries

- Transactions by accounting year & account, e.g. Internet & Telephone for current year

Another cool feature is that Dividend Vouchers are automatically created and ready to be signed by a Director. This is the sort of legally required task that small business owners (like me) need to do but often forget until it’s sometimes too late.

Another cool feature is that Dividend Vouchers are automatically created and ready to be signed by a Director. This is the sort of legally required task that small business owners (like me) need to do but often forget until it’s sometimes too late.

As a non-Accountant much of this is alien to me but my accountant really appreciated it when preparing the annual accounts. Either way, it’s strangely reassuring to know that all the accounts are always there and up-to-date.

Other Things I Like

User Experience

FreeAgent is a pleasure to use, which is saying a lot given the subject.

There are very few software services that I have been able to write that about. Enough said.

Give Your Accountant Access & Negotiate a Fee Reduction

FreeAgent makes it easy to set up multiple user accounts. This can be useful for another member of your team, your virtual assistant and crucially for your accountant.

My accountant’s assistant was able to sign-in and access everything she needed to prepare my annual accounts. She had never used the service before, had no training and did not need to ask any questions. Impressive.

If you currently use an accountant then before signing-up with FreeAgent, I’d advice asking them if they’d be OK to use it. It can only make their lives much easier too. So much so in fact that it would be worth negotiating a fee reduction: by at least the annual service cost.

Plays Nicely With Other Apps & Services

FreeAgent works with a bunch of other services, apps and widgets including HMRC, Basecamp and Capsule CRM. New ones are being rolled at all the time.

Support

I’ve put several questions to the FreeAgent team and had nothing but fast, friendly and helpful responses.

They also have an active Community Discussion forum, and a Knowledge Base with helpful articles, tutorials & videos.

Pricing

FreeAgent is aimed at UK-based small businesses and freelancers.

Sole trader – £15 per month

Partnership/LLP – £20 per month

Limited Company – £25 per month

Prices attract VAT.

You can get twelve months for the the price of 10.

There are no sign-up or other costs and the contract is pay as you go, and so can be cancelled at a month’s notice.

Things That Could Be Better

No review is complete or credible without covering what could be better. I pick out here two things that would significantly improve the service for me.

Payroll

One of my aims last year was to automate payroll. The plan was to setup standing orders for salary and PAYE/NI taxes, and track it all within FreeAgent. And, to have FreeAgent automatically fire off the relevant filings.

It turns however that FreeAgent does not calculate the precisely correct PAYE and NI amounts. Also, it does not generate and file the legally required forms like P35, P14 and P11D.

I ended up wasting hours trawling through HMRC documents trying to figure for myself what forms needed to be filed and when. I decided to pay my accountant to do this for me. This works out (for me) at more than the total cost of the FreeAgent service, and is on top of his normal fees.

If you don’t need anyone on PAYE then of course this is not an issue. But if you do, then bear in mind that you’ll either need to invest the time to do it all yourself, or pay an accountant to do it for you. But again, negotiate.

This is the biggest downside of FreeAgent in my opinion, and needs to be sorted out ASAP.

Lack of automated bank feed

This is a relatively minor issue but it would be so much better to have an automated feed from my bank to FreeAgent.

I asked them for an update as I wrote this and was told (within 15 minutes by email) that they “…are working on automatic bank feeds at the moment however cannot confirm any release date so please accept our apologies for this.”

Conclusion

Overall, I am extremely happy with FreeAgent for dealing with all my limited company accounts.

I recommend this service to any small UK-based sole trader, partnership (LLP) or limited company who would like to benefit from the significant ‘peace of mind’ and time savings that I’ve experienced from this reliable, easy to use and largely automated accounting system.

FreeAgent have a free 30 day trial.

If asked, make sure you enter the following referral code: 3vbqfxnl

(Disclosure: I get a small commission if you use my referral code in exchange for referring you to them. We all win!)

Have you tried FreeAgent? What are your thoughts?

Update (19 September 2013): FreeAgent now offers automated feeds from many banks. They also offer much improved PAYE services though I’ve not used them yet myself.